Ripple is a peer to peer network to trade currencies, at the moment Bitcoins make up the bulk of trading but it can work with any currency and accept Dollars, Yen or Euros. Ripple also has its own native currency called ripples, represented by the letters XRP, ripples do not have to be necessarily used to trade with others, they are there to stop network abuse by imposing a ripple tax on transactions and they could be used for direct trading as a last resort.

Ripples do not need mining, the founding company, OpenCoin, has already premined one hundred billion ripples, instead of creating more units, like the Bitcoin network does, Ripple works the other way around and reduces the fixed number of available ripples by distributing them to others.

An example of a Ripple trade could consist in you loading Bitcoins to your Ripple address (they all start with r and look like a Bitcoin address, example of my public ripple: rpzoTc4YVnRig39MqZqYVM9ae1LhPAnMLj), transfer that money to a different Ripple account and convert it back to Dollars using a gateway. Ripple to Ripple transfer fees are tiny or free, but when you use an intermediary gateway to exchange different digital currencies, the intermediary will charge you for the service, in that sense is not any cheaper than a Bitcoin exchanger.

Advantages of using Ripple over Paypal are that opening an account requires no ID verification, transactions can not be reserved, fees are tiny and it can be used worldwide to buy anything you like without worrying about terms and conditions. The huge disadvantage over Paypal is that unless it takes off, it will not be easy to convert ripples into physical items or hard currency.

A comparison of Ripple vs Bitcoin should not apply here because Bitcoin is a digital currency and Ripple a currency exchange network and payment processor more similar to Paypal or MtGox.

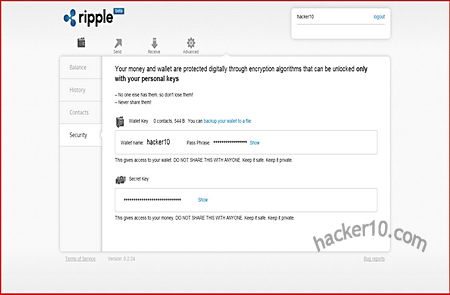

Cryptocurrency Ripple wallet

There are Ripple detractors pointing out that Ripple founders, OpenCoin, keep 20% of the mined ripples for themselves, many Bitcoiners make profit too so I can’t really hold that against them, more worrying to me is Ripple being vulnerable to collapse if the authorities raid all of the trading gateways or they force the gateway operator to allow bugging equipment to be installed in the server. Unlike Bitcoin, where the customer can also be a miner, in Ripple you can’t do anything without a gateway administering transactions.

It is good to have alternatives, and perhaps one could use Ripple to make money transactions harder to track but I don’t see too many reasons to use them over let’s say Bitcoin exchanger MtGox. Even with redundant P2P servers, Ripple is still vulnerable to server seizure, just not as much as a single server system.

Winston Smith

“…Ripples do not need mining, the founding company, OpenCoin, has already premined one hundred billion ripples…”

Without looking too much more into it, I find this comment here a serious problem. Already “premined” ? Sounds like they just make Ripples out of thin air just like the Federal Reserve system.

Amschel Mayer Rothschild (1773-1855), made a statement in 1883:

“Permit me to issue and control the money of a nation, and I care not who makes its laws.”